How to use the VAT calculator

Calculating VAT for VAT-inclusive and VAT-exclusive prices has never been easier. Only 3 easy steps for VAT calculation:

| 🗺️ Country of VAT | Ireland |

| 💷 Currency of VAT | Euro (€) |

| 📈 Standard rate | 23% VAT |

| 📉 Reduced rate | 13.5 9 4.8 VAT |

The 13.5% rate applies to fuel, electricity, vet fees, construction, arts and theatre tickets, cleaning services, catering and restaurant services.

The 9% applies to newspapers, electronically supplied publications, sporting activities’ facilities.

The 4.8% applies to livestock in general, and to horses that are normally intended for use in the preparation of foodstuffs or for use in agricultural production.

Check the VAT rate – it’s preset to 23 percentage

Enter the amount – Net amount or Gross amount

Click "Remove VAT" or "Add VAT" to calculate VAT amount.

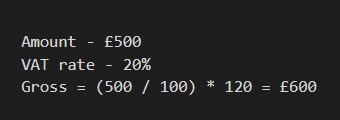

If you want to add VAT to the price, you just need to divide the price by 100 and then multiply by (100 + VAT percentage). That's all, you got the price including VAT (Gross value).

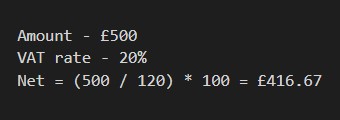

If you want to remove VAT from the price, you need to divide the price by (100 + VAT percentage) and then multiply by 100. Now you know the price exclusive VAT (Net amount).

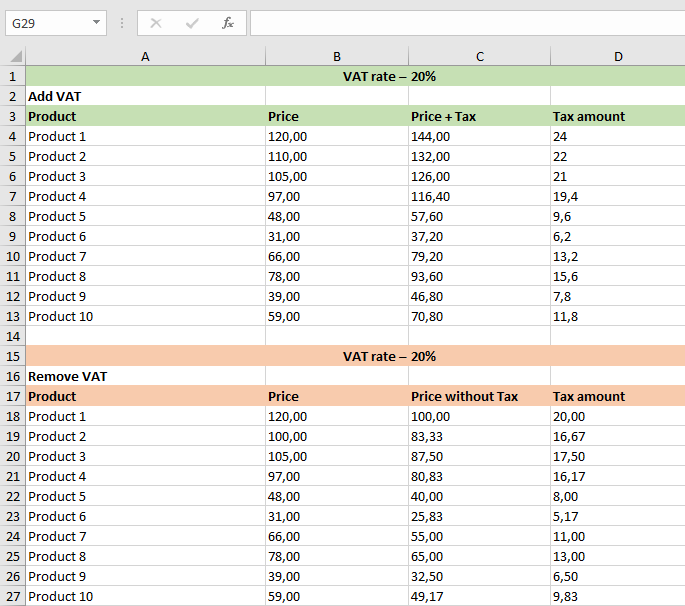

If you need to calculate VAT for several products at once, it is easier to use Excel. I created a template for reverse VAT calculation – download, it's free.

Rates vary according to what you’re supplying, and there are four main categories to think about: standard rate, reduce rate and zero-rated. Rates are subject to change and you must apply changes from the date they change read more..

To verify the validity of the VAT number you can use the official services. If you need to check the VAT number of a European company, try VIES VAT number validation. For UK companies there is an UK VAT number checker.

VAT was first introduced in France in 1954. The UK VAT rate was originally set at 10% and gradually increased over time, rising to 20% in 2011, and has remained so ever since.

In the 2019/2020 tax year, the UK generated £129.88 billion in VAT revenue. VAT is the third largest source of government revenue after income tax and National Insurance.

Hungary has the highest VAT rate in the world at 27%, followed by Iceland with 25.5%. Countries that don't charge VAT at all include the Bahamas, Hong Kong, Saudi Arabia and Qatar.

Brands that have fought and won VAT victories include Jaffa Cakes and Tunnocks Snowballs, which have successfully proven that their products are cakes (VAT-free) and not cookies, which in turn are subject to VAT.

The highlight for the media was the emergence of Pastygate in 2012. The government's proposal to start charging VAT on takeout items such as hot sausage rolls and pastries met with widespread disapproval.

Goods with a zero rate of VAT in the UK include: children's clothing, most foodstuffs, books and prescription drugs. Other items not subject to VAT include visits to museums, antiques and postal services.