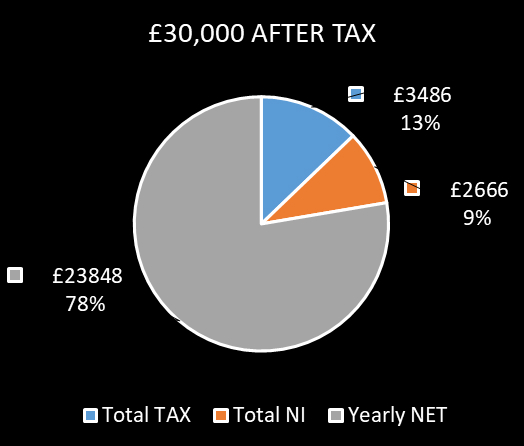

How much is £30k after tax?

The Vatulator tax calculator calculates how much PAYE and NI will be taken from your salary per week, per month and per year.

Yearly Monthly Weekly

| Gross Pay |

£30,000 |

| Income Tax |

£3,486 |

| National Insurance |

£2,666 |

| Take home pay |

£23,848 |

This calculation is for guidance only, and does not in any way constitute financial advice. We advise you to consult a specialist regarding any major financial decisions. These income tax rates are from the HMRC website and are correct from 6 April 2024 to 5 April 2025.