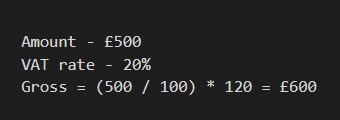

If you want to add VAT to original figure, to divide the amount by 100 and then multiply by (100 + VAT percentage). That's all, you got inclusive of VAT value (Gross amount).

For example, we will calculate VAT at a standard UK VAT rate of 20. If your business sells goods and services for £500

We will calculate VAT at a reduced VAT rate of 5. If your business sells goods and services for £1000

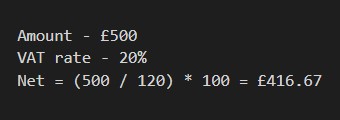

If you want to subtract VAT from a figure (to make a reverse VAT calculation), to divide the amount by (100 + VAT

percentage) and then multiply by 100. Now you know the amount exclusive of VAT (Net amount).

For example, we will calculate VAT at a standard UK VAT rate of 20. If your business sells goods and services for £500

We will calculate VAT at a reduced VAT rate of 5. If your business sells goods and services for £1000

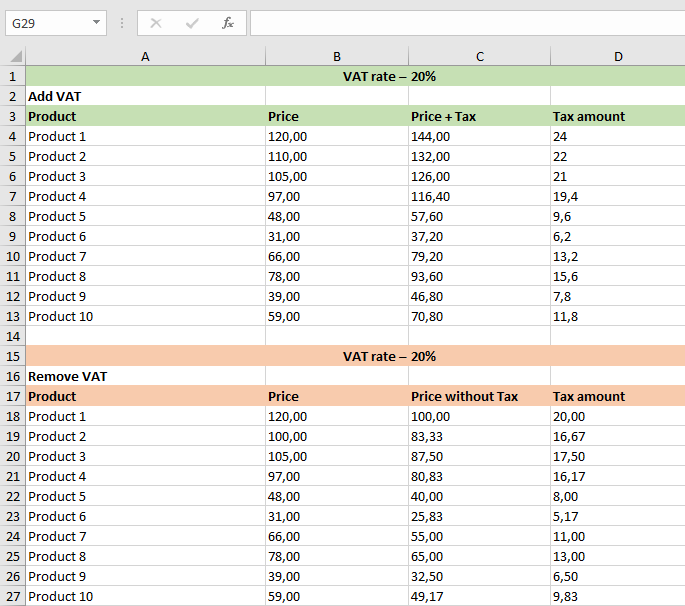

If you need to calculate VAT for several goods at once, it is easier to use Excel than a our VAT calculator. I created a Excel spreadsheet – download, it's

free.

Fresh coffee beans first come from the local farmer. If the roaster pays a total of £5 per pound of fresh coffee beans, a VAT of £1 (£5 x 20%) is added to this cost, so that the farmer receives a total of: £6 for each pound of coffee beans from the roaster.

The roaster roasts the coffee beans and charges the coffee shop owner £10 per pound of roasted coffee beans. This means that the shopkeeper has to pay a total of £12 per pound, £10 for the roasted coffee beans and 20% VAT, which is £2. However, since the farmer has already paid the first £1 to the HMRC, the roaster only has to pay the government £1 in VAT.

A coffee shop owner can use each pound of roasted coffee beans to sell 5 cups of coffee at £4 each for a total of £20. For every 5 cups of coffee sold, the store owner receives a total of £24 from customers who bought his coffee, £20 and £4 VAT. However, since a total of £2 in VAT has already been paid to the state by the farmer and the roaster, the shopkeeper pays only £2 to the HMRC.