| Reduced-rate items | Zero-rated items | VAT exempt items |

|---|---|---|

| Children's car seats | Children's clothing and shoes, public transport | Betting and gaming |

| Women's sanitary products | Books and newspapers | Subscriptions to membership organisations |

| Residential conversions | Food - except meals in restaurants | Fundraising events by charities |

| Installation of energy-saving materials | Most goods you export to a country outside the UK | Some education and training |

| Domestic fuel and power | Motorcycle helmets | Providing credit and Insurance |

The standard rate of VAT in the UK was increased from 17.5% to 20% on 4 January

2011.

The reduced rate of 5% is applied to some goods and services such as children’s

car seats and home energy.

Zero VAT rate is applied to a range of products and services to do with health,

publishing and kids’ clothing.

| Date | VAT changes |

|---|---|

| 1st April 1973 | 10% Value Added Tax has been introduced in the UK |

| 29th July 1974 | VAT rate reduced to 8% but 25% fuel tax introduced |

| 18th June 1979 | Value Added Tax rate increased to 15% |

| 1st April 1991 | The VAT rate has been increased to 17.5% |

| 1st December 2008 | Standard sales tax rate reduced by 15% |

| 1st January 2010 | The standard rate was increased to 17.5% and a reduced rate of 7% was introduced |

| 4th January 2011 | The standard VAT rate is increased to current 20% and the reduced rate is set at 5% |

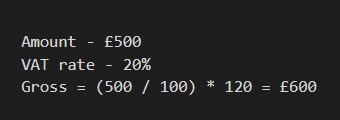

If you want to add VAT to the price, to divide the amount by 100 and then multiply by

(100 + VAT percentage). That's all, you got the amount including VAT (Gross). To make sure you get

it right, better use our calculator.

For example, if your business sells sports equipment for £500

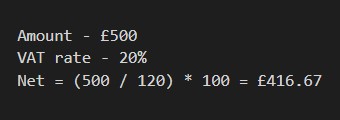

If you want to remove VAT from the price, to divide the amount by (100 + VAT

percentage) and then multiply by 100. Now you know the amount exclusive of VAT (Net). If this is

difficult for you, use our calculator.

For example, if you bought a laptop for a Gross price £500

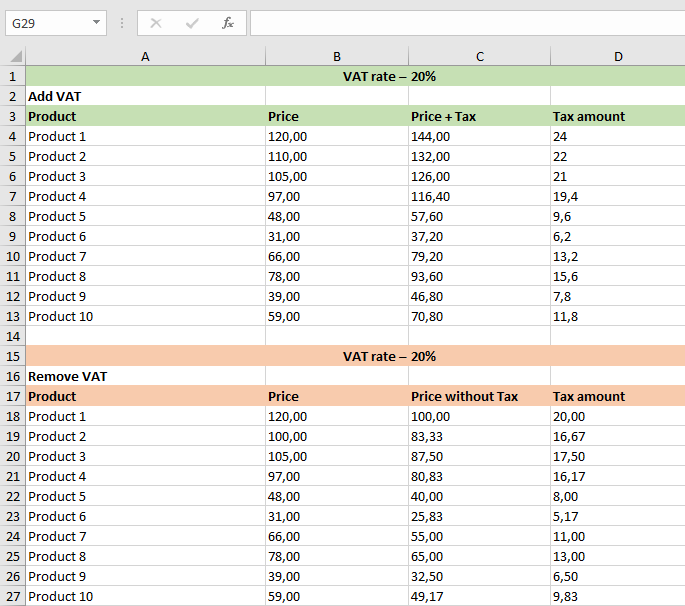

If you need to calculate VAT for several goods at once, it is easier to use Excel

than a calculator. I created a template for reverse VAT calculation – download, it's free.

Rates vary according to what you’re supplying, and there are four main categories to

think about: standard rate, reduce rate, zero-rated and exempt supplies. Rates are subject to change and

you must apply changes from the date they change read more..

To verify the validity of the VAT number you can use the official services. For UK

companies there is an UK VAT number checker. If you need to check the VAT number of a European company,

try VIES VAT number validation.

The Flat Rate Scheme is open to businesses with a turnover of less than £ 150 000,

and it’s designed to simplify the VAT process – particularly for freelancers, contractors and small

businesses. You have to make sure you apply to HMRC to sign up for it read more..

Well, that depends on your particular circumstances. If your turnover in a 12-month

period reaches the current £85,000 threshold, then registration is compulsory – and if you don’t do it,

you’ll receive a fine as a penalty. If you don’t hit this figure, then registration isn’t obligatory read

more..

VAT was first introduced in France in 1954. The UK VAT rate was originally set at 10% and gradually increased over time, rising to 20% in 2011, and has remained so ever since.

In the 2019/2020 tax year, the UK generated £129.88 billion in VAT revenue. VAT is the third largest source of government revenue after income tax and National Insurance.

Hungary has the highest VAT rate in the world at 27%, followed by Iceland with

25.5%. Countries that don't charge VAT at all include the Bahamas, Hong Kong, Saudi Arabia and

Qatar.

Brands that have fought and won VAT victories include Jaffa Cakes and Tunnocks Snowballs, which have successfully proven that their products are cakes (VAT-free) and not cookies, which in turn are subject to VAT.

The highlight for the media was the emergence of Pastygate in 2012. The government's proposal to start charging VAT on takeout items such as hot sausage rolls and pastries met with widespread disapproval.

Goods with a zero rate of VAT in the UK include: children's clothing, most

foodstuffs, books and prescription drugs. Other items not subject to VAT include visits to museums,

antiques and postal services.

Vatulator reviews & testimonials: see what other are saying. You can also leave your review here or on Smart Reviews, Trustpilot, G2 or Capterra

Christian, thanks for the feedback! In my calculator you can change the VAT rates as you like. I have also made pages for South African and Irish users. There is also a Ukrainian and a Russian version of the VAT calculator

Please add export data to excel. I think you should add other calculators such as IR35 or a dividend tax calculator.

Vatulator is a quick and efficient tool for calculating how much money you pay for a certain product. Sadly, the only region it can be useful in is the United Kingdom. I wrote a full review here https://www.softpedia.com/get/Others/Finances-Business/VATulator.shtml